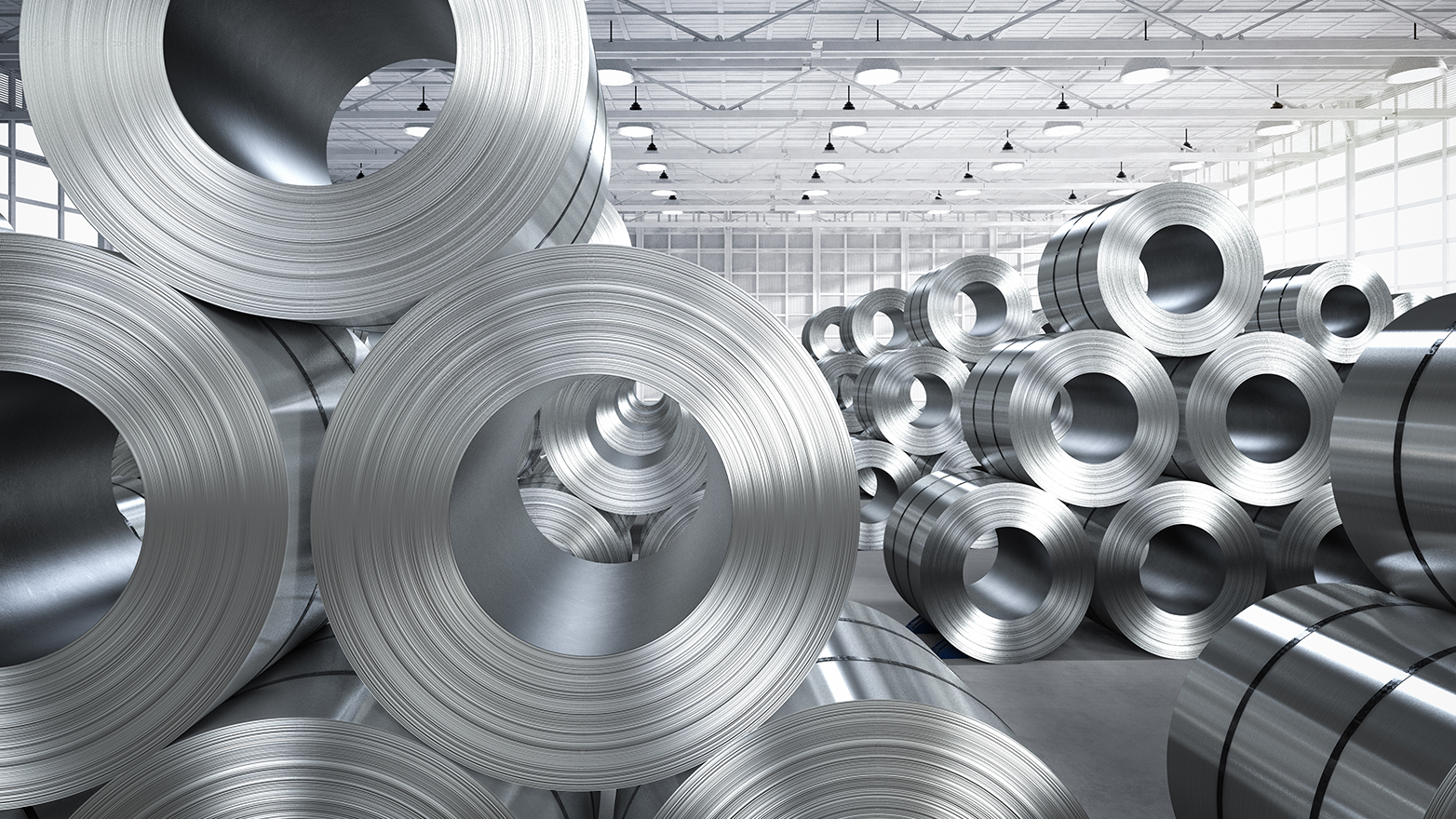

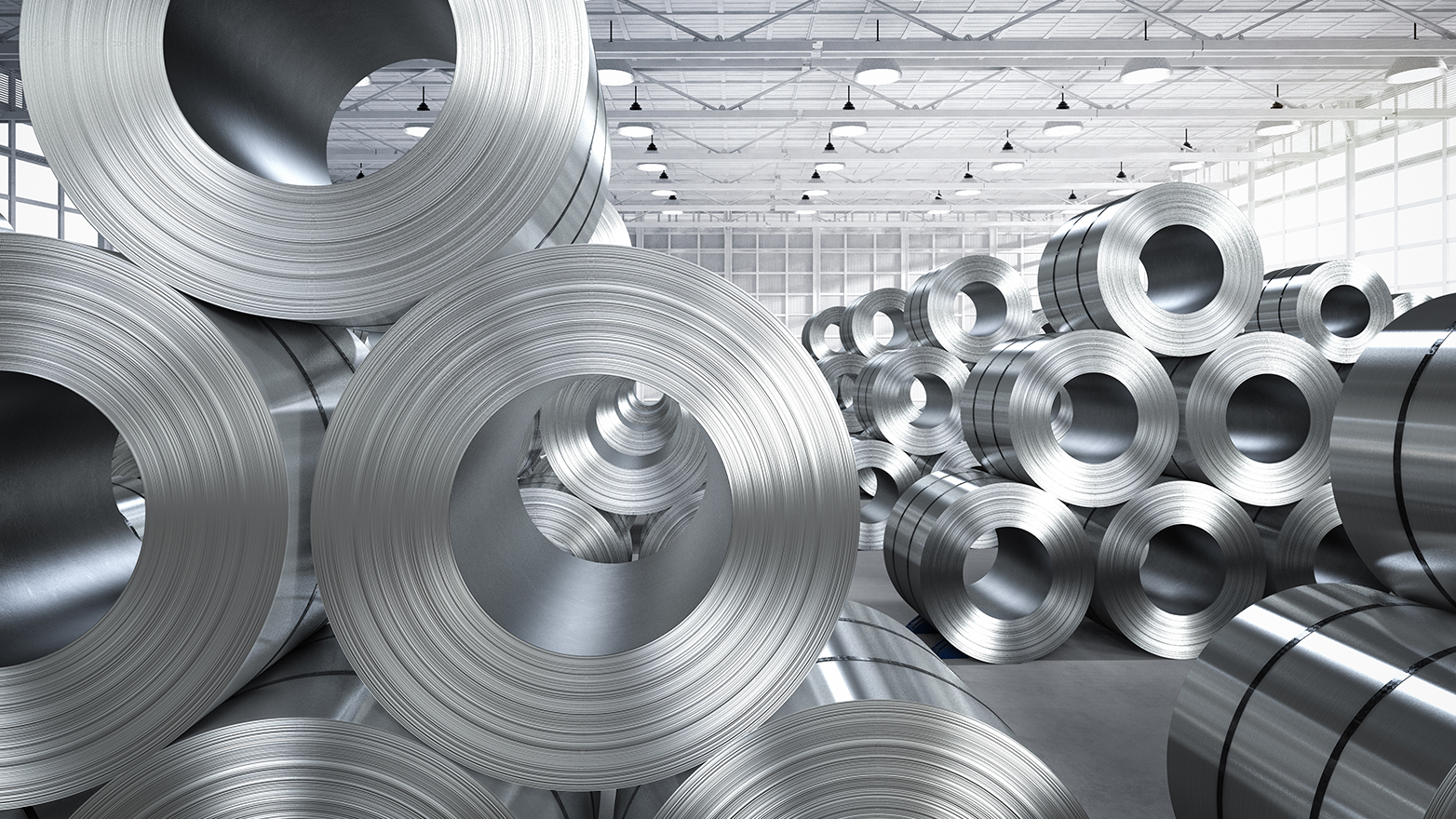

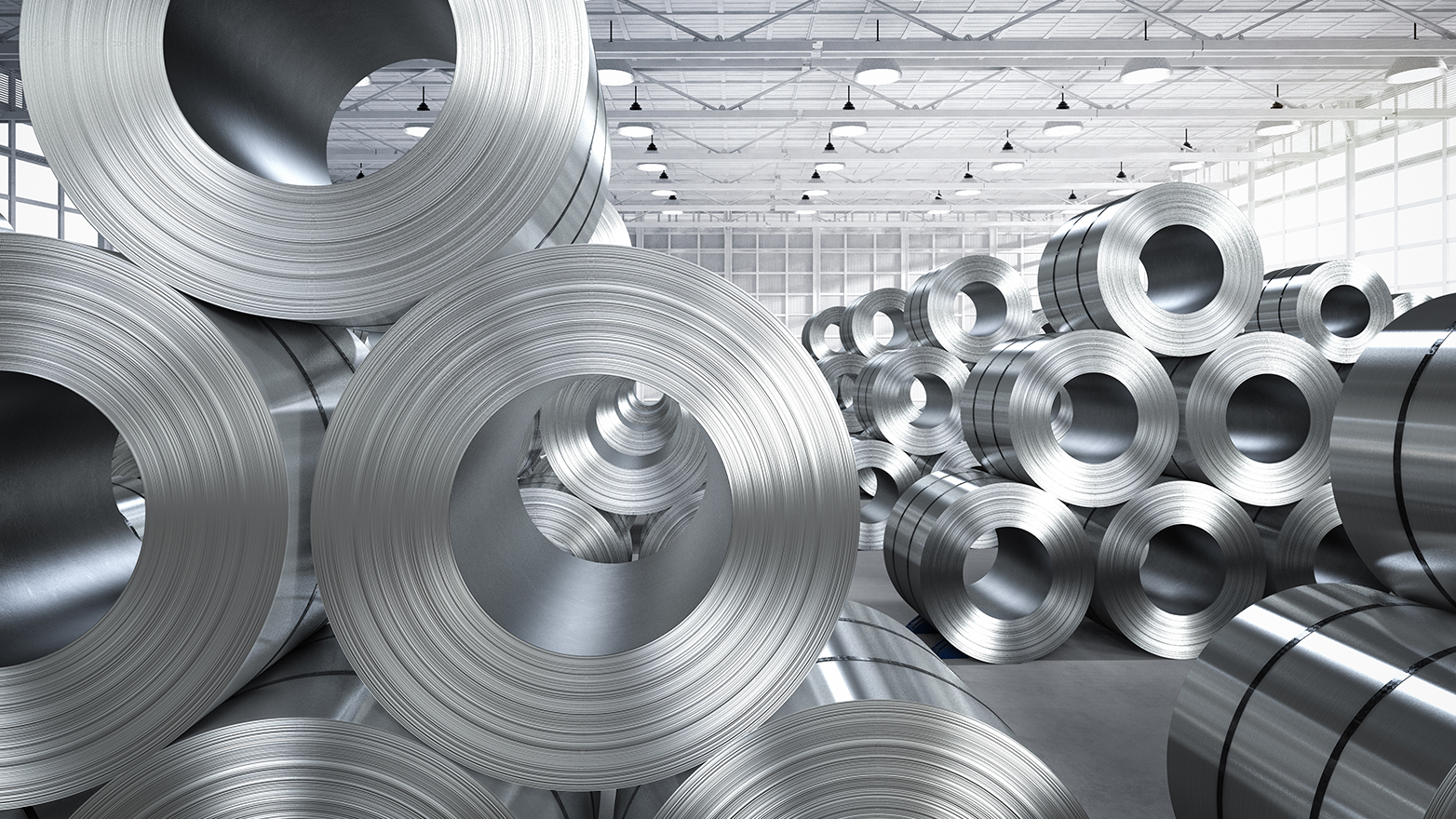

Metals Market Commentary

Trading multiples(1) for the Metals sector as of 03/31/2023 recorded an overall mean EV / 2023E EBITDA of 6.7x:

- Mills & Foundries at 7.2x

- Processing & Distribution at 7.3x

- Recycling & Reclamation at 6.6x

- Manufacturing & Fabrication at 5.6x

Aggregate revenue is forecasted to grow by a CAGR of +1.8% during 2021-2024 across the Metals peer group

Driven by an economic environment of looming recession and heightened inflation, metal prices closed 2022 lower than the beginning of the year. While the Russia-Ukraine war lingers to weigh on global economic activity, China’s reopening and relaxation of its zero-COVID policy has generated optimism on the demand outlook, supporting global metal prices.

Near-record low inventories and subdued imports owing to uncompetitive arbitrage and watchful ordering would also play a role in firming metal prices. Multiple price hikes posted by domestic mills that witnessed a reversal in their earnings in 2022 are pushing prices further.

Although the U.S. Manufacturing Purchasing Managers Index (PMI) is currently hovering at low levels, infrastructure spending and the automotive sector are expected to be the bright spots in the coming years. The $1.2 trillion U.S. Infrastructure Bill, aimed to add new funding for metal-intensive activities such as bridge rehabilitation, public transportation upgrades, and electric grid modernization, is expected to fuel demand. Non-residential construction should remain robust driven by the need for schools, hospitals, malls, and other commercial buildings to support residential communities. The automotive sector is poised to maintain positive momentum on the back of unmet, latent demand and easing supply chain constraints, albeit at a slower pace given shrinking wallet size and increased borrowing rates.

Various federal government measures, such as the ‘Buy America’ campaign and metal import duties, are helping ensure continued demand for domestically produced metals. Furthermore, an acceleration of reshoring trends would boost revenues for metal companies as construction of advanced manufacturing facilities is highly steel intensive. Local small-to-mid-sized fabricators are also expected to profit from these facilities requiring custom metal services.

2022 EV / LTM EBITDA Performance(1)

2023 LTM(2) Indexed Stock Performance(1)

We hope you find this information valuable, and as always, feel free to reach out if you would like to discuss in further detail. To read the full report, download the PDF below.

Download the document:

Metals Newsletter - Q1 2023

Download PDFExplore more

Industrial markets

KPMG Corporate Finance LLC’s investment bankers have extensive Industrial Markets transaction and industry experience, which enables them to understand the industry- specific issues and challenges facing our clients.

Metals Newsletter Q2 2023

M&A activity and industry trends

Metals Newsletter Q3 2023

M&A activity and trends

Metals Newsletter Q4 2023

Read more about M&A activity and trends in the sector

Meet our team

In today’s market, you need an advisor with objective insight at every step of the transaction process. We work with you throughout the full deal cycle to create value and successfully execute your deal strategy.